LIC Term Insurance or Pvt Life Insurance Term Plan ? Which is the best term insurance in India ? Which Insurance company has the best claim settlement Ratio? Online term Insurance or Offline Term Insurance ? These are some of the questions which comes in the mind of every Term Insurance buyer! . So are you looking for Term Insurance comparison at one place ? Do you have all the sufficient information to decide which is the Best Term Plan you can buy? Today I will show you all the data like riders, maximum/minimum tenure, max age till when term plan covers a person and data on the premium, Claim settlement Ratio at one place! . There are many term insurance plans in India, but all of them have different premiums and features which confuses a prospective customer to choose the best term plan for him. If you any question about Term plan you can look at these 9 most asked questions about Term Insurance

Looking at above comparison chart you would have got a fair idea about the online term plans also, which have recently made its entry in India.

Note : The premiums displayed are indicative and should not be considered as final premiums as they are taken from online insurance comparision sites. Its only for illustration purpose and very much correct as on Dec 2010 . They might change in future, please check the premiums on the respective websites.

Brief overview of Riders

AD (Accidental Death) : The policy pays you additional sum assured in case the death happens due to an accident . Note that even if you don’t take this rider, the sum assured is always paid on death, whether accidental or not !.

CI (Critical Illness) : This rider gives you a lump sum amount if you are diagnosed with an illness which is mentioned in the policy . Generally all the major illnesses are covered in Critical Illness cover.

DR (Accidental Disability Rider) : This rider covers you for disability and pays you Sum assured in 10 installments per year incase you becomes temporary or permanent disabled person.

WP (Waiver of Premium) : This rider makes sure that incase you are not able to pay future premium due to disability or income loss, the future premiums are waived off , but your policy is still in force like always !

Claim settlement Ratio of Insurance Companies

While deciding on a term plan, the biggest point which a person concentrates is the Claim settlement ratio (read this comment) . So here is the list of all the Insurance companies in India with the claim settlement ratio . The data are from the recent IRDA report for 2009-2010. One important detail you should note down is that 8 out of 23 life Insurance companies have reported profits , which are LIC, ICICI Prudential, Kotak Mahindra, SBI, MetLife, Bajaj Allianz, Sahara India and Aegon Religare . If you do not beleive in Term Plans then you should read this article .

Online Term Insurance vs Offline Term Insurance

With online term plans coming in market, two things has happened. First, Customers have really got excited seeing very low premiums which insure them at throw away prices, however low premiums does not appear on the top wish list of customers and what everyone needs is very high claim settlement ratio and excellent customer service. This is where online term plans have disappointed customers, there has been huge disappointment from ICICI iProtect and Aegon Religare iTerm Plan in terms of customer service. There have been cases where customers bought the online term plan and after that, they had horrifying experiences starting from increase of premium once they bought it, No-response from the company for long duration and Long & frustrating delays in medical tests. This is what pisses off customers most and they get a feel that If situation is bad at the time of buying the policy, then what will be the response when their families for claim settlement .

Another important point which comes to a persons mind is Are private Insurance companies safe ? and what is the claim settlement ratio of the company. From last year IRDA report, we came to know that Aegon Religare did not settle even a single claim out of total 7-8 claims they got . However, this years IRDA report (2009-2010) shows that its better at 48% settlement ratio for Aegon Religare, but Life Insurance is not a maths exam where 90-91% marks will make people happy. We all need 100% or 99% at least !. Because most of the companies are very new, the trust factor is missing from public. Note that not everyone who bought online term plans had bad experience, there are many buyers who got very good response and good customer service, but it was a smaller section .

So if you a kind of buyer who understand Insurance very well and how things work in this area and you also have trust in online term plans then you can go for online plans. But if you are not comfortable with it, then you should try the old way of buying insurance through an agent. However it would cost more than online term insurance, which many are comfortable with! .

If you concentrate on the claim settlement and trust factor then the only option is LIC Term Insurance (Jeevan Amulya). However if you are fine with the pvt Insurance, but still want the best features, I personally see Kotak-preffered Plan as a good option. The premium for Kotak-Preffered is the lowest in the offline term plans and this plan has good riders along with other good options. Term Plan from LIC is obviously the best option if you do not believe in the pvt companies and insist on high claim ratio, but premium for LIC term plan is too high . So I think you can consider a mix of the LIC term insurance and any one from Pvt insurer.

Special Features in Some Term Insurance Policies

There are some term plans with very different set of features. Lets have a look at some of the those. These features can help you further in your decision.

Which term plan do you have currently and incase you planning to have one, which one those the above will you buy ? Will it be LIC Term Insurance or some one else and why ? Also share, If you need any other factor before choosing the term plan ? Which one do you think makes sense out of online and offline term plan ? Give your suggestions .

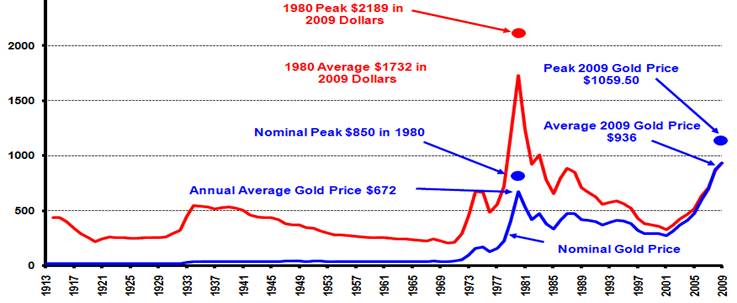

Today also, each emperor (so called Government) produces and controls their own currency as DOLLOR, Rupee, Dinar etc. But internationally, gold still remains the purest form of currency as it cannot be manipulated. Now in paper currency world over, Dollar became the most acceptable currency as US economy is still the biggest and almost all countries trade with US. After US dollar, the most acceptable form of currency is GOLD. If you have gold and you are not carrying dollar, you can still buy items in any country of the world but you cannot do so with Indian Rupee. Hence, in economic terms, gold is a currency.

Today also, each emperor (so called Government) produces and controls their own currency as DOLLOR, Rupee, Dinar etc. But internationally, gold still remains the purest form of currency as it cannot be manipulated. Now in paper currency world over, Dollar became the most acceptable currency as US economy is still the biggest and almost all countries trade with US. After US dollar, the most acceptable form of currency is GOLD. If you have gold and you are not carrying dollar, you can still buy items in any country of the world but you cannot do so with Indian Rupee. Hence, in economic terms, gold is a currency.