Saturday, November 19, 2011

મોંઘા જમીન સોદાએ ગુજરાતમાં નવો વૈભવી ગ્રાહકવર્ગ ઊભો કર્યો

પોર્શ સમૃદ્ધ ક્લાયન્ટ્સનો તૈયાર ડેટા બેઝ મેળવે છે જેમાંથી મોટા ભાગના ક્લાયન્ટ્સ ગ્રામીણ વિસ્તારમાં રહે છે. ગુજરાતમાં પોર્શની 20 ટકા કાર ગ્રામીણ વિસ્તારોમાં વેચાય છે.

આકર્ષક જમીન સોદાએ ગ્રામીણ ગુજરાતમાં એક નવો ગ્રાહકવર્ગ ઊભો કર્યો છે અને હાઈ-એન્ડ કાર અને કન્ઝ્યુમર ગૂડ્ઝ કંપનીઓને પરંપરાગત માર્કેટિંગ ટેક્નિકો છોડીને દેશી પદ્ધતિઓ અપનાવવાની ફરજ પાડી છે. લક્ઝરી પ્રોડક્ટ્સ ખરીદવા ઇચ્છતા ગ્રાહકોને મેળવવા માટે પરંપરાગત શોરૂમમાં રીતભાતમાં ધરખમ ફેરફાર કરવામાં આવ્યો છે.

રૂપિયો ઘટતાં NRI વતનમાં વધુ નાણાં મોકલતા થયા

રૂપિયાના મૂલ્યમાં થયેલા ઘટાડાનો લાભ લેવા માટે વિદેશમાં કામ કરતા ભારતીયો વિક્રમજનક પ્રમાણમાં ડોલર ભારત મોકલી રહ્યા છે , જેથી ડોલરના ઊંચા મૂલ્યનો લાભ મેળવી શકાય અને ભારતીય બેન્કો દ્વારા ઓફર કરવામાં આવતું ઊંચું વળતર મેળવી શકાય. આ બાબત વધતી જતી રાજકોષીય ખાધ સામે સંઘર્ષ કરી રહેલી સરકાર માટે મોટી રાહત બની આવી છે.

એકલા સપ્ટેમ્બર મહિનામાં જ કથિત એનઆરઓ ખાતામાં 56.5 કરોડ ડોલર આવ્યા છે , જે છેલ્લા 30 માસમાં સૌથી વધુ છે. ઓગસ્ટમાં પણ આ મૂડીપ્રવાહ અત્યંત ઝડપી લગભગ અડધા અબજ ડોલર જેટલો હતો.

નોન-રેસિડન્ટ (ઓર્ડિનરી) ખાતામાં ડોલરનો મૂડીપ્રવાહ મહત્ત્વનો છે , કારણ કે તે રૂપિયામાં જમા થાય છે. આનો અર્થ એમ થાય કે દેશમાં વિદેશી ચલણ જમા થાય છે અને ઉપાડ ફક્ત રૂપિયામાં થાય છે. દર વર્ષે વિદેશમાં વસતા ભારતીયો દ્વારા એક ટ્રિલિયન ડોલર સુધીની રકમ સ્વદેશ મોકલવામાં આવે છે.

મહિનામાં ડોલર સામે રૂપિયો 52 થઈ શકે : HDFC બેન્ક

ET નાઉ : હાલમાં ડોલર સામે રૂપિયો ગગડીને 51 ની સપાટી વટાવી ગયો છે તો હવે આગામી દિવસોમાં રૂપિયો ક્યાં પહોંચશે 51.5 કે પછી 52?

આશિષ પાર્થસારથી : હાલમાં રૂપિયો દબાણ હેઠળ છે તે વાત ચોક્કસ છે. હવે રૂપિયો કઈ દિશામાં ગતિ કરશે તેની ચોક્કસ આગાહી કરવી ખુબ મુશ્કેલ છે પણ એકાદ મહિનામાં તે 52 નું સ્તર પણ વટાવી શકે. જોકે , તાકિદે રૂપિયામાં કોઈ મોટી વધઘટની શક્યતા હવે ઓછી જણાય છે. જો કોઈ મોટા નકારાત્મક કે ખરાબ સમાચાર ન આવે તો થોડા સમય સુધી રૂપિયામાં નજીવી વધઘટ જોવા મળશે. હાલના તબક્કે રૂપિયાના મૂલ્યમાં સુધારો થવો જોઈએ.

ET નાઉ : આ અંગે મધ્યસ્થ બેન્ક ક્યારે પગલાં ભરશે તેમ તમને લાગે છે ?

આશિષ પાર્થસારથી : માર્કેટ રિપોર્ટના અભ્યાસ પરથી હાલના તબક્કે એવું જણાઈ રહ્યું છે કે , રૂપિયામાં જોવા મળી રહેલી વોલેટિલિટીને અંકુશમાં રાખવા માટે સેન્ટ્રલ બેન્ક સ્પોટ અથવા તો ફોરવર્ડ માર્કેટ દ્વારા દરમિયાનગીરીની વિચારણા કરતી હશે.

આ સ્થિતિમાં સેન્ટ્રલ બેન્ક પરિસ્થિતિ પર સતત વોચ રાખતી હશે પણ કયા સ્તરે તે દરમિયાનગીરી કરશે તે કહી શકાય નહીં. સેન્ટ્રલ બેન્ક ફોરવર્ડ માર્કેટના સંદર્ભમાં પણ આવી જ મોડ્સ ઓપરેન્ડી અજમાવશે તેવી શક્યતા છે.

ET નાઉ : ડોલરની મજબૂતીને તમે કેવી આંકો છો ? અને આપણા માટે ડોલરની ખરેખર માંગ કેવી છે ?

આશિષ પાર્થસારથી : આપણા દેશનું અર્થતંત્ર ચાલુ ખાતાની ખાધ ધરાવતું છે. તેથી સ્વાભાવિકપણ જ વિદેશી હુંડિયામણની માંગ તો રહેવાની જ. આ માંગ મોટે ભાગે FDI, પોર્ટફોલિયોના મૂડીપ્રવાહ અને ECB દ્વારા પૂરી થતી હોય છે.

માર્જિન મનીની ચિંતાથી મિડ-સ્મોલ કેપ્સ ધોવાયા

નિખિલ ગાંધીની પીપાવાવ ડિફેન્સ એન્ડ ઓફશોર એન્જિનિયરિંગ અને દિલ્હી સ્થિત રિયલ્ટર પાર્શ્વનાથ ડેવલપર્સે ઘટાડાની આગેવાની લીધી હતી. બજારમાં તીવ્ર ઘટાડાથી આ પ્રમોટર્સના ધિરાણકારો માર્જિન મનીની માંગણી કરશે એવી ચિંતા છે.

વેન્ચુરા કેપિટલના ભરત શાહ (હેડ , ઇન્સ્ટિટ્યૂશનલ ઇક્વિટી)એ જણાવ્યું હતું કે , મોટા ભાગના મિડ-કેપ શેરોના ભાવમાં છેલ્લા ત્રણ મહિનામાં 30 થી 60 ટકા ધોવાણ થયું હોવાથી ઘણા મિડ-કેપ કાઉન્ટર્સ પર માર્જિન કોલ આવ્યા છે.

શાહે જણાવ્યું હતું કે , જે પ્રમોટર્સ માર્જિન કોલની જરૂરિયાત સંતોષી શક્યા નથી તેમના ગીરવે મુકાયેલા શેરને ધિરાણકારો વેચી રહ્યા છે. ઋણનાં નાણાંનો ઉપયોગ કરીને મિડ-કેપ શેરોમાં પોઝિશન લેનારા રોકાણકારો પણ દબાણ હેઠળ આવશે.

બીએસઇનો મિડ-કેપ ઇન્ડેક્સ એક ટકા ઘટીને છેલ્લા 28 મહિનાના તળિયે પહોંચ્યો હતો જ્યારે સ્મોલ-કેપ ઇન્ડેક્સ 1.9 ટકા તૂટીને 29 મહિનાની સૌથી નીચી સપાટીએ બંધ થયો હતો. સતત સાતમા દિવસે બેન્ચમાર્ક સૂચકાંક ઘટ્યા હતા જેમાં સેન્સેક્સ 0.6 ટકા અથવા 90 પોઇન્ટ ઘટીને 16,371 પર બંધ થયો હતો.

ફંડનો ખર્ચ ઊંચો છે અને વ્યાજદર ઘટવાના સંકેત ન હોવાથી ગીરવે મૂકેલા શેરની ચિંતા વધી છે. રોકાણકારોને લાગે છે કે શેર ગીરવે મૂકનાર પ્રમોટર્સ આવશ્યક નાણાંની જોગવાઈ નહીં કરી શકે.

Get your LIC Policy details by SMS

Do you run around LIC offices to get information about your policies ? If yes, now there is some good news for you , you can get basic information about your LIC policy very easily by SMS. You can get general information like Bonus amount vested till date , details of nominations etc by just send one SMS t0 56677. This is a free service.

ASKLIC

where -

Premium – Instalment premium under policy

Revival – If policy is lapsed, Revival amount payable

Bonus – Amount of Bonus vested

Loan – Amount available as Loan

NOM – Details of Nomination

Example

AskLIC 8955940009 NOM

One can also get LIC pension related information by SMS

LICPension

Where-

a) IPP Policy Status, (STAT)

b) Existence Certificate Due, (ECDUE)

c) Last Annuity Released Date, (ANNPD)

d) Annuity Payment thru (CHQ/ECS/NEFT) (PDTHRU)

e) Annuity Amount (AMOUNT)

f) Cheque Return Information (CHQRET)

What is Your Policy Number?

The policy number is consist of nine digits and can be found at the top left hand corner of the schedule of your policy bond.

Did you knew this information ? Kindly share if this worked for your LIC policyAre you suffering from Mental Accounting ?

Do you know that majority of the problems in your financial life are purely because of psychological reasons? We are all humans and are prone to think irrationally at times, due to which, a lot many wrong decisions are taken in our personal finance. Behavioural Finance is the area of finance that combines psychology and finance together and gives you an insight as to how a common man makes mistakes in his decisions. Today, I am going to talk about on its concept called ‘Mental Accounting’.

Lets imagine a scenario, which will give you a brief idea on mental accounting .

Scenario 1 : You and your wife visit an electronics showroom with the intention to buy a Laptop. After browsing various products you finalize a nice laptop with the price tag of Rs. 40,000. Just when you were to swipe your credit card, the couple behind you mentioned that another showroom about 3 blocks away (15 min drive max) is selling the same laptop for Rs. 39,800. Will you consider driving 15 mins to save Rs.200? Majority of us will not do so!

Scenario 2 : You and your wife visit the same electronics showroom to buy 4 GB Pendrive costing Rs.400. However, you come to know that this product is available for Rs.200 at another showroom which is 15 mins drive. So will you now choose to drive another 15 mins to buy this Pendrive? Most of us will happily choose to drive 15 mins to the second showroom.

If you look at both the scenarios, you will notice that both scenario 1 and scenario 2 are exactly the same, they both will save you Rs. 200 and both requires you to drive 15 min. Exactly same, no difference. But most of the people will choose the first showroom only in scenario 1 and will choose second showroom in scenario 2.

Why does this happen ?

Truly speaking, this happens because of Mental Accounting which makes Rs. 200 saved on laptop not a significant amount because its just 0.5% of the original price. Whereas, Rs. 200 saved on Pendrive looks attractive and substantial bargain because its 50% of the original cost.

What is Mental Accounting ?

Mental Accounting is very simple to understand. What makes is a crucial aspect to understand is the different ways we treat money depending on situation and its source. We often concentrate on the situation and the source of money in terms of the amount of hard work we put to get that money and all these points makes us human to fall prey to treat same amount of money in different ways. But coming back to the facts, Money is Money and it doesn’t matter where it comes from!

So, if you earn Rs. 100 from 3 different sources- Lottery, Salary or Tax Refund, all of them should mean the same as they all have the same purchasing power. Forget how you got it; all of that Rs.100 is valuable equally!

Personal Experience of Mental Accouting

Let me share on how I myself was a victim of Mental Accounting. Some 2 years back, when I did my first stock market trade in F&O. I made Rs. 2000 as profit on an investment of Rs. 6000 in the matter of 2 hours (options trading). This increase of Rs. 2000 actually increased my overall wealth, but to me it was ‘Cheap Money’. Naturally, I had made plans to spend this money and I had no 2nd thoughts on NOT spending. The decision to spend money was not at all rational, but it was fast money which came from stock market and it came without any hard work. Mental Accounting was doing its job in my mind!! Carefully evaluating the situation, all what happened here was that my networth went up by Rs. 2000 and I took out Rs. 2000 and SPENT it!

6 Examples of how our personal finance decisions are based on Mental Accouting

1. Treating some money as “Free-Money” or “Loose-money”

Most of us label money based on where it comes from, by doing so the value of that money appears to be less. E.g. if you get food coupons from your company, you will not consider it as cash! At the last company I worked at, it was amazing to see that people didn’t mind paying up to Rs.50 for Food Coupons for friends, but if the same person had to spend Rs. 10 hard cash, he will not be willing to do so. Food coupons have same purchasing power (at least in limited environment) as cash, so one should be treating it in the same way and not being bias just because it’s not in the form of currency. What I really want to know is that what will happen if companies start providing cash equivalent of these food coupons???

Another example can be with the money that we get from tax refunds, cash gifts on events etc…etc… We all in our heads label these as ‘Cash, but not as valuable’. Imagine that you got Rs. 2000 as your tax refund and you are more likely to be spending this money rather than the willingness you would have to spend from your salary. Also imagine that some friend gave you Rs. 1000 as gift voucher, will you even bother researching on what products can this voucher buy??? In the same way, if you earn yourself a bonus of Rs. 50,000; you will be more inclined to spend it on a holiday or for buying some item for the house. Would you do the same thing with the money from your salary??

So the message is clear, don’t label money as ‘salary money’, ‘tax refund money’, ‘bonus money’ or ‘Gift money’. It’s just MONEY!

2. Holding Stocks and Mutual funds with Loss

Mental Accounting is visible in buying and selling of equity products like stocks and mutual funds. Consider a person who bought shares at Rs. 100 each and the current price drops to Rs. 80. He does not consider this as loss until he books it, loss is not existent for him, and it’s just a possibility. But in real terms, that person is actually suffering loss already. The person in this case labels the loss as ‘potential’ and not ‘real’. On the other hand, if the same stock went up from Rs. 100 to Rs. 120, he will be happy and will be telling everybody that how he is in ‘profit’ even though he has not booked as yet. Profits have already happened according to this person’s thinking and this is exactly why many people fail in stock investments.

3. Size of the decision/money involved

A lot of times the size of the transaction also influences our thinking. Imagine that you went to buy a Plasma TV which costs Rs 20,000. You bargain with the vendor and successfully get a discount of Rs 500; it makes you happy and you feel as if you saved something. But do you put any big effort to find out how you can save much on groceries or vegetables? As the transaction size is bigger and bigger money is involved in case of Plasma TV, it clicks your mind that you should try to bargain the price and save as much as you can, but this thinking is not the same in case of small purchases. Even if we are able to save Rs 5 on small transactions, it would amount to Rs 1700 (approx) in saving in whole year and that would be bigger than Rs 500 saved in case of Plasma TV.

While there can be repetitive headache involved in saving that small amount, the whole idea is to communicate that we tend to think differently when there is a big decision and very different when in smaller ones.

4. Earn less interest and pay more interest

Many investors do the common mistake of earning less interest on their FD’s, PPF or Cash in their Savings account, but pay huge interest on their personal loan or credit card interests. For investors, money in FD’s and PPF is ‘safe’ and not to be touched, but in true sense you are earning less on a part of your portfolio and from that same portfolio you are paying huge interest for loans. If you see your whole portfolio as one and single element without labelling parts of it, your perspective will change. Ideally one should clear a liability whose interest rates are higher than the part of portfolio earning lesser interest . But due to mental accounting , this idea does not look fine to many people .

5. Labeling money into safe money and risky money , loosing any money is just loosing

Ajay has Rs 1,00,000 in Bank FD, Rs 2,00,000 in his PPF account and 5 lacs in Balanced Mutual funds. All these investments are for his daughter’s education down the line and he has mentally labelled it as ‘safe’. However Ajay has also separated out Rs 50,000 to try out stock trading which is his passion and what he loves to do. He has mentally labelled this Rs 50,000 as ‘Risky’. You can see his total worth is 8.5 lacs.

Case A: Now imagine he is in loss of Rs 25,000 in his stock trading. This will not hurt him so much as he had accepted from start that it’s for stock trading and loss was a possibility. He is fine with this loss, as nothing has happened to his ‘safe’ investments.

Case B: Suppose market is down and he faces a loss of Rs 25,000 on his mutual funds. As the loss has happened in his mutual funds which was initially labelled as ‘safe’ and “for-his-daughter’s-education”, the level of disappointment and worry would be much bigger than Case A.

Even though the reaction of Ajay was different in both case A and case B, it’s purely because of mental accounting and the way he had unconsciously labelled both investments of his portfolio, but in both the cases the reality is that his total net worth went down from 8.5 lacs to 8.3 lacs, It’s as simple as that.

6. Paying for Financial advice

We recently encountered a very funny situation, one of the readers contacted us for our Financial Coaching service, he was very clear that he needs it (For readers who are not aware about financial coaching, it’s a paid program where we coach people in their financial life just like Garry Kirsten coaches Indian cricket team and transformed their performance). He was very much interested in being coached on his finances and what MONEY means to him, but was very uncomfortable paying the fee out of his wealth, as for him there were other important things in life; he said he would get back to us once he makes the decision. But he didn’t communicate for weeks, then just last week he told us that now he is ready for Financial Coaching. After we started his work, we asked him, what had happened in his life which motivated him to take our service. To our surprise, he had sold his old car and got price way beyond he expected, and he was fine to use that extra money to improve his financial life.

If you look at this incident closely, even the money which he got by selling his old car become the part of his overall wealth, the moment he sold it, in fact it was always part of his wealth even when he didn’t sold it. You must be thinking what was our first coaching lesson for him? Yes, it was the way he looks at different aspects of his financial life and not fall prey to these kinds of behavioural patterns.

7. Treating unexpected money in a different way

There are lot of unexpected money at times coming in our life , It can be money in form of Bonus from your company , It can be money recieved from an old friend who took it from you ,didnt give back to you and you also forgot about it. It can be some money you find in old book which you had secretley kept long back . All these are examples of “unexpected” money and hence there is no mental accout for it , that money looks more of pocket money to you and you tend to spend it without thinking much .. However money is money , no matter from where it came . Its just different in your mind .

Please share your real life incidents where you fell prey to mental accounting . Do you think mental accounting is not applicable in real life and is more of a “time pass” concept or do you think its really something one has to understand and apply in their financial life ? Share your views

Does Sushil Kumar (KBC winner) require a Financial Plan ?

We all know that Sushil kumar has won 5 crores from KBC few days back (actually 3.5 crores after tax) and now he is already being approached by wealth managers, relationships managers to advise him on how to “invest his money”. So I want to just discuss my thoughts with you all on how Sushil kumar should put his money at work ? Does he really need a Financial Plan ? Does he really need an advisor ?

Let us see what he can do with his money and how I think he should utilize his 3.5 crores. Given his background and education level and assuming that he listens to me, here is what I would suggest Sushil Kumar. Divide your money in 4 buckets A (1 crore) , B (1 crore) , C (1 crore) and D (50 lacs)

Bucket A (Security of future)

The first thing which I would tell Sushil Kumar is that he should just keep things simple and simply keep that 1 crore in a Fixed Deposit and let it accumulate there without any complication. This part of his wealth should be there incase THINGS GO HORRIBLY WRONG ever , he can just leave this part as it is for growth, even if its going to increase at a slower pace compared to equity or anything else.

Bucket B (Regular Income and Security of Capital)

I would suggest him to use the next bucket to generate a regular income along with his capital being secure, again there can be many ways of doing this , but considering his background and assuming that he might not be too sure about financial matters , again I would recommend him to put his next 1 crore into a fixed deposit with a monthly or a quarterly payout of interest . This will make sure that his initial capital of 1 crore is secure and he will start getting an income of Rs 65,000 – 70,000 per month (before tax) .

This income of 65,000 – 70,000 will be more than enough for him to live his regular life, thanks to him not very much addicted to junk foods , extravagance and other useless spendings which our generations have. He will surely be left with a lot of money each month or quarter and thats where he can put some money in equity on regular basis . No stocks , no mutual funds , just plain index funds, so that he does not have to bother about funds not performing every year and does not require a short-term review.

Bucket C (Assets creation , Education , Business)

Once his worst case is covered (bucket A) , his regular income is taken care , now he can use the next 1 crore for building a new house for himself and his family , he can also use some part of his money to fund his education and some part he can use to start a new business which can again open a new stream of income for him) . This purpose of this 1 crore is to take care of all the things which he wanted to do in his life. This part is not to save , but to utilize for his aspirations and his dreams.

Bucket D (Enjoying his Life)

I think he should use the last 50 lacs to just blow off and enjoy his life on regular basis which a lot of people just dream of . He should take a vacation abroad first using 10-12 lacs and then rest of the money he can use to go for a regular vacation each 6 month , with 35 lacs he can get a 2.8 lacs a year as interest income which would be enough for him to take 2 vacations a year with whole family ![]() . The focus of this 50 lacs can be purely for enjoyment purpose because his other area’s in financial life are complete.

. The focus of this 50 lacs can be purely for enjoyment purpose because his other area’s in financial life are complete.

Other Suggestions

- Life Insurance is not required for Sushil Kumar because there is no requirement of Life Insurance, There is enough wealth with him and his family incase he is not around.

- Health Insurance would be something nice to have as it would come at a small cost compared to what he has in life, this would make sure that someday if something goes wrong , his wealth is protected against the unexpected expenses.

- He should stay away from any relationship manager , Agents or even Financial Planners as there is more for “Allocation” and less to “Plan” . He has already passed the Accumulation phase and only if he takes care of his existing wealth now, he should do good.

- Because of his less knowledge (assumption) about overall personal finance, he should keep things simple and be with simple products like Fixed Deposits which he understands properly.

Sushil kumar real enemy might not be inflation or ignorance about money, but his own relatives and Bihar goons ! . So what do you think about these suggestions to Sushil Kumar ,? Do you agree with it ? How would you allocate his 3.5 crores if you had to do it ?

PPF interest rate hiked to 8.6% , investment limit to 1 lac

Govt on Friday increased the PPF interest rates to 8.6% , which was 8% from very long time. Also the investments limit has been raised to 1 lac from the old 70,000 . This will be effective from Dec 1 , 2011 . Apart from this Post office saving rates are increase from 3.5% to 4% , KVP (Kisan Vikas Patra) has been discontinued from now.

Also, The maturity period for monthly income scheme and NSC has been cut to 5 years and interest rates hiked to 8.2 per cent and 8.4 per cent, respectively.

Cheques and Demand Drafts will be valid for only 3 months of issue

From next year all the bankers cheques , demand Drafts and pay orders will only be valid for next 3 months from the date of issue. It will be expired and become invalid if you dont use it within limit period of 3 months. As of now this limit is 6 months , but from April 1 , 2012 this is going to change.

Reserve Bank of India said that this move was intended to stop the misuse of the six-month validity period by ‘some persons’ who were circulating such instruments in the market like cashConsolidated details of transactions for Mutual Funds Investors

From now, All the Mutual fund investors will get a monthly consolidated statement of all of their transactions in different fund houses mutual funds, said – Association of Mutual Funds in India (AMFI) . “This is an investor-friendly initiative to allow investors a single-window view of all their transactions in mutual funds,” Chief Executive of AMFI H N Sinor said. The basis for consolidation and grouping for all the transactions will be PAN provided for the investments.

Note that this monthly statements will come to investors along with the regular statements they get from AMC’s .

Monday, November 14, 2011

How do Highest NAV Guarantee Plans work ?

Now a days, we are seeing a new “Innovative” product in the market. They’re called Highest NAV Guaranteed Plans .These products have come in, after the recent crash in the market, and companies are taking advantage of the fact that Investors are looking for some kind of a safe investment equity product. Hence, they’ve launched these Highest NAV Return ULIP’s which confuse investors and make them (the investors ![]() ), believe that they are going to get the highest return from the Stock market in long run – generally the tenure is 7 yrs, for these plans .

), believe that they are going to get the highest return from the Stock market in long run – generally the tenure is 7 yrs, for these plans .

In this article, we look at how Highest NAV Guarantee ULIP’s work, and you will understand, how any Guarantee product can be created by simple methods . The simple catch, here is that these schemes, are structured in such a manner, that the collected funds can be invested either in equities, debt instruments or in money-market instruments in proportions varying from zero to 100%

How Highest NAV Guarantee Policy Works ?

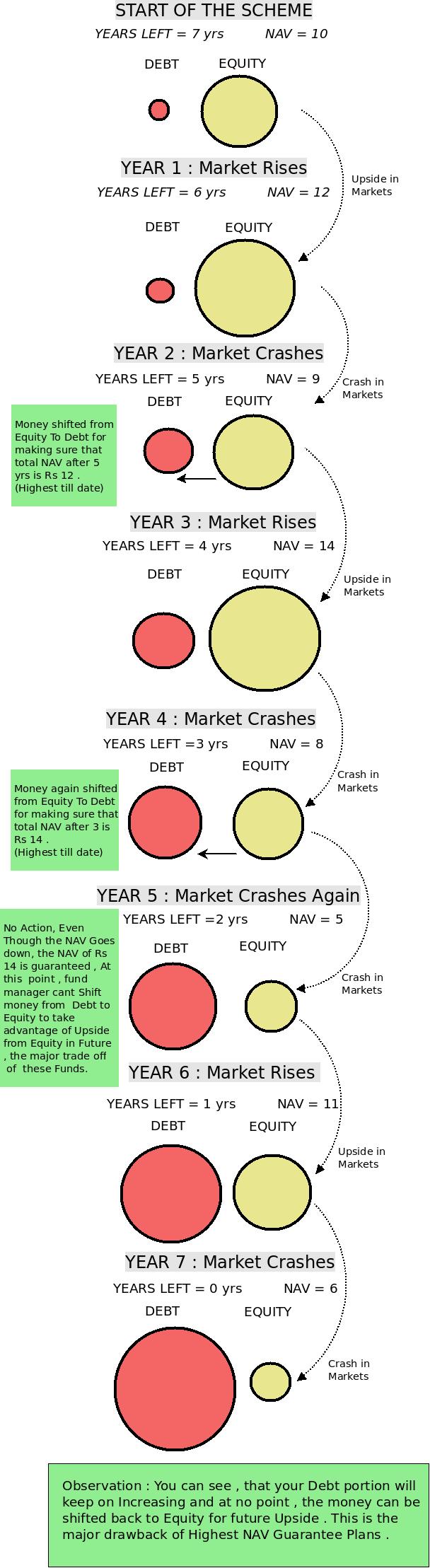

These plans use strategies like Dynamic Hedging and CPPI (Constant proportion portfolio insurance), which are advanced strategies used in Derivatives world. But, let me explain a simplified version of the whole process.

Supposing a policy starts today and is guaranteed to give highest NAV in next 7 yrs and we can control how money moves to debt and equity, its pretty simple.

In the beginning, let’s assume a NAV of Rs 10, and the Asset allocation is 100% in equity and 0% in debt . Now suppose, the market moves up and NAV goes upto Rs 15 by the end of the first year, at this point, try to understand what Insurance company has to provide – they have to make sure, that they provide at least Rs 15 as the return after 6 yrs . Now in order to achieve this, all they have to do is keep X amount in debt instruments which will mature in next 6 years and provide Rs 15 at the end of 6 yrs, so assuming the debt return at 7%, they need to put around Rs 10 in Bonds , so that the maturity of the bond is Rs 15 at the end of 6 yrs .

=> 10 * (1.07)^6

=> 15.007

They can now invest the rest Rs 5 in Equity as Rs 10 is allocated to Debt . So, now they’ve made sure that whatever happens to the market, they get Rs 15 for sure at the end of 6 yrs. Now, there are two possibilities

Case 1 : Market Goes down : If market goes down, the NAV will go down correspondingly, but as per the strategy, the maturity value will be at least Rs 15.

Case 2 : Market Goes up again : If market goes up at this point and the NAV rises above 15, for example say to Rs. 18, now again they will pull out money from Equity and allocate such an amount to debt, that the maturity at the end of total 7 yrs would be Rs 18 and so on…

Note :

- These highest guaranteed schemes do not provide wide range of product categories, such as equity-oriented growth funds, balance funds and debt funds.

- Guarantee on highest NAV is available only if you survive the term. If you die during the term, your nominees will get the prevailing value of the fund. This is inferior to even a regular debt product because of the high cost structure involved.

Following is a pictorial description of how the Guaranteed NAV plan works with assumption of a 7 year tenure.

How Investors get Confused

You have to read in between the lines; Investors need to understand that these schemes guarantee the “Highest NAV”, READ AGAIN! , it’s Highest NAV and not “Highest Returns” . Normal Investors don’t give much thought before buying these products and normally assume that the returns will be linked to the Equity Markets .

Returns from Highest NAV Guarantee Plans

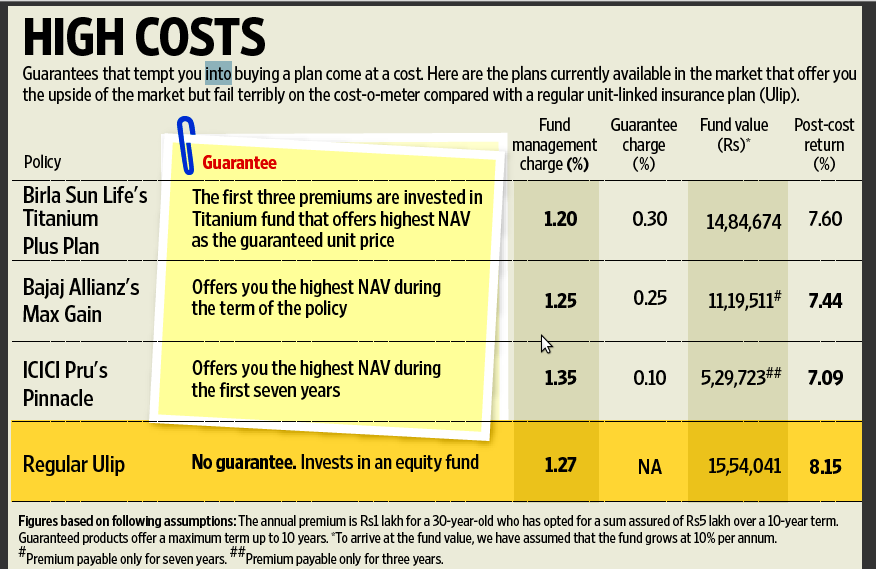

So, what are the return expectations of these funds? We know, that long-term equity returns, are normally in the 12-15% range while, debt returns turn out to be 6-7%. So, considering the fact, that these products will shift most of their money to debt, by the end of the tenure , we can expect the returns to be in range of 9-10%. We do get some equity upside in these products, but that will be limited. After a point, this product will turn into a debt oriented fund with a major portion in debt . Also if you factor in costs, like premium allocation charges , fund management charges and other yearly charges, the returns will not be what you actually expect.

You will be amazed to know, that the returns expected from these schemes, may be lower than the returns offered by equity-oriented Ulips. The reason being, that the basic objective of protecting the previous high NAV of the fund, may constrain the fund manager’s ability to take risks while allocating funds. So if the market has fallen down, the fund manager can’t take the risk of shifting the money from Debt to Equity to gain from the potential upsides in future , because they have to provide the “Guarantee.”

Read : Important Questions you should Ask an ULIP Agent ?

Source : LiveMint Research

Current Products in Market with Highest NAV Guarantee

- ICICI’s Pinnacle

- Birla Sun Life Platinum Plus-III

- Bajaj Allianz Max Gain

- SBI Life Smart Ulip

- Tata AIG Apex Invest Assure

- LIC Wealth Plus

- Reliance Highest NAV Guarantee Plan.

- AEGON Religare Wealth Protect Plan

Controlling your emotions with these products

Let’s talk about mistakes from the investors point of view. We, as investors, don’t think with inquisitive, susceptive minds. Getting good returns from stock markets is anyways a tough thing in itself. So when these companies come up with plans like these, which say “highest NAV in 7 yrs”, we have to ask, “How is this possible?” . Dont say it’s not possible at all, just ask how? How do they achieve it? Stop seeing dreams of getting high returns without looking at the risk involved, and try to find out – what is the strategy they’re using , Is there something in between the lines ?

We all want to get great returns, but we have to shed this belief that, companies come up with plans specially for us. All the companies out there exist to earn money, and their motive behind every product is to make money, & generate profits for their companies, so that they keep their shareholders happy. So next time a product like this comes up , you have to control your emotions before getting in and first investigate. The worst part of this whole business, (of guaranteed highest NAV products) is the timing and how it gives naive investors, high illusions about the product. Products like these, take major advantage of psychology of the ordinary saver. Many Investors in smaller towns have broken their Fixed Deposits and taken some loan to invest in products like these, especially SBI Life Smart Ulip and LIC Wealth Plus because of the trust factor with LIC and SBI . See How Agents are Misselling LIC Wealth Plus

Why you should be “Pissed off” At these Insurance Companies

- Do you Know that, The Securities & Exchange Board of India (SEBI) , the stock market and mutual fund regulator, does not allow mutual funds to guarantee returns. Therefore Mutual funds can not provide guaranteed products which are related to stock markets, but IRDA can approve things like these and all these insurance companies come under the ambit of Insurance Regulatory and Development Authority of India (IRDA). So any Insurance Company can come up with a new Plan , link it with market and start providing “Guaranteed products” . You have to understand that “equity markets” and “guarantees” are a very risky idea together , so please stay away.

- Do you observe when do all these “Innovative” products come up in Market ? The answer is around end of the year, which is a premier Tax Investment time (Jan , Feb , Mar) . Is innovation in Finance space limited to End of the year ? Why dont these products come through out the year? Why ? The answer is simple , if it comes after anytime other than last 4-5 months of the Financial Year (ie Dec , Jan , Feb , Mar) , no body will bother to invest in these, because no body is bothered to “invest” at all . Companies very well understand investors psychology and their helpless ness at the end of the year because they have to provide investment proofs for Tax exemption as soon as possible . This is not just limited to these products , its true for NFO’s , IPO’s in booming markets , More Sales calls at the end of the year, and other new products .

- The so-called “Guarantee” is a marketing gimmick and is implicitly a result of the way the investment is structured . what it means is that the strategy they use itself is such that it will provide you the highest NAV , even we can create our own Plan and do what they are doing . But they make sure that Investors feel like they have done years of research and came up with these amazing plans .

- Why The Tenure is 7 yrs ? I am not very sure on this , but here are my thoughts on comments area

- You have to understand that there is nothing “Innovative” in this product , the fact that 7 companies have come up with the same product proves that its not “innovation” because Innovation is unique . Aegon Religare has gone ahead in this stupidity and introduced their Guaranteed Plan which guaranteed 80% of the Highest NAV , Looks like they think that it makes them look different from others .

Who should Invest in These Products ?

If you are looking for modest returns, like 8-10%, you can invest in these policies. The return of these policies may be high in the beginning, if market does well; but when market starts performing badly, the returns can take a hit and then be in a tight range. Your NAV will be protected for sure, but the returns wont be, since over time the CAGR return will go down. Remember, if your NAV is 10 today and you highest NAV is 20, for a 2 year period, the return is a good enough 41%, but by the 4th year it’s just 18.9% and by the end of 7th year it’s a measly 10.4%. So what you really need, is protection of returns, not the NAV which is just a fixed number.

Is someone misusing your Financial Documents ?

Is it a total truth that you are too careful with your documents? Did someone recently asked for your PAN Xerox (extra) copy without any reason and you gave it without thinking much? Do you handover your Driving license or passport copies to some agent without giving it a second thought? If yes, you need to be careful because this can land you in trouble in big way. There has been a lot of cases reported on this blog by your fellow readers which you can learn from. Let me take some of them.

How one relative misused the pan card for taking loan

A lot of people handover their documents to their relatives without thinking much. They feel they are helping the other person, but you never know how the other person can misuse your documents and get you in trouble. Read this case

One of my cousion taken a two wheeler loan in 2005, and i had given my pan card duly self attested at the time of taken loan.

Now i had applied for 2 wheeler loan in 2010, it got rejected upon applied to CIBIL report i came to know that i m the coapplicant of the two wheeler loan taken by my cousion in 2005. But unfortunetly he died in 2010 . So i had made the complete payment including all bouncing charges as well as the principal amount dues on him. But as i am the co-owner as per the bank records my name also reflect as an overdues amount (Defaulter) in your CIBIL Report which is harming my credit Worthiness in the market. I just spoke to the HDFC CUSTOMER CARE DEPT they said your loan is clear and had been reported to CIBIL upon checking again with CIBIL ,now report shows as settled . I had made full payment still its showing settle please help me out what i need to do now Please note that i do not have any direct dealing with the bank in the above said loan i just made a mistake of giving my sign in the reference column for which i have paid a price of making payment of RS 6322 to bank. (source)

How one friend used friends reference to make his co-applicant

Friends are forever, until they take advantage of your trust. A lot of people give their documents to their friends for being a reference (guarantor), but they themselves don’t understand what does guarantor mean? Read this below case to know what happened with one person

One of my friends took a car loan from a nbfc 3 years back and he wanted a reference for this loan (i now realize there is no such thing as a reference for a loan) i obliged and gave him a duplicate copy of my pan card. For atleast 2 years i have been applying for credit cards and getting rejection letters from all the banks. I finally was fed up with this and decided to get my cibil report and was shocked to see that i was the co-applicant for the car loan my friend had taken 3 years back. He had defaulted on this loan which was reflecting on my cibil report and that being the main reason for me not getting any credit card.

Like i mentioned earlier i had given my friend a copy of my pan card but i had never signed any loan application form, so i followed up with my friend (who still claims that i was supposed to a reference for this loan) and also with the customer care at the NBFC (who i must say were extremely rude). I managed to get the loan application form from the NBFC and i’m a cent percent sure that my signature has been forged on the form. Now my friend (would not want to call him a friend anymore) claims that the person who gave him this loan never told him about me being a co-applicant and he always thought i was only a reference. (source)

How an agent used documents of someone to to take advisor license

We call a lot of agents to home to buy financial products ,we give them our financial documents without realising that it can be misused if we dont want to go for the product later , we never ask it back . Read the following case based on this.

It has come to my notice that an advisor license was taken in my name in MetLife, Asansol Branch under Sales Manager by the name Mr. Debrup Banerjee. This person had approached me for a Life Insurance policy and had some papers signed by me. The Policy never materialized, but the papers (EPIC, PAN Card, Photo) was used to take out a License in my name. In fact, I was working in Bihar Sharif when the IRDA Exam was taken. A more serious and criminal act on part of Mr. Debrup Banerjee was to open an account with the Axis Bank in my name using the same papers. SMS alerts from MetLife has brought these misdeeds of Mr. Debrup Banerjee to my notice. I would request you to take necessary steps to declare the Advisor License, taken by Mr. Debrup Banerjee for MetLife, null and void. (source)

Make sure you take care about whom you are handing over your financial documents to. People can misuse it and take advantage which can get you into trouble later and you will come to know about it only when things are out of control.

PPF interest rate now at 8.6%, investment limit 1 lac

There is good news for all the investors who are primarily debt instruments investors. Govt on Friday increased the PPF interest rates to 8.6% , which was 8% from very long time and the investment limit for PPF is increased to 1 lac from old 70,000 . This will be applicable from the dates which will be notified by govt very soon. There are some other changes which were done in other investment products , which are

Source : Hindustan Times

- The Maturity tenure for National Saving Certificate (NSC) has been reduced to 5 yrs (earlier it was 6 yrs) and interest rates increased to 8.4% from 8%

- A new National Savings Certificate (NSC) would be launched with a 10-year maturity with an annual interest rate of 8.7 per cent.

- Post office savings account interest is increased from 3.5% to 4 per cent.

- Interest on loans obtained from PPF will be increased to 2% p.a. from existing 1% p.a

- Kisan Vikas Patra has been discontinued from now onwards . The committee had said that the KVP was a bearer-like certificate with a regulated premature closure facility and was open to abuse by tax dodgers. They can be bought or sold without going to the post offices.

- Maturity period for Post Office Montly Savings Scheme (POMIS) has been reduced to 5 yrs and interest rate has been increased from 8% to 8.2%. Also the 5% bonus on maturity has been scrapped.

- Commission for agents on PPF and Senior Citizens Savings Schemes are scrapped. For any other instruments, agents commission will now be 0.5% against 1% earliar . According to the Gopinath Committee, the agents were paid around Rs 2,400 crore commission in 2010-11.

- The interest rates of varios tenures fixed deposits in Post Office is increased , for example for 1 yrs Fixed deposit , the new interest rates is 7.7% against 6.25% earliar . There are changes in other tenure fixed deposits also (See image above) . This has happened because interest rates on small saving instruments have been aligned with G-sec rates of similar maturity, with a spread of 25 basis points.

These measures are in sync with the recommendations of former RBI deputy governor Shayamala Gopinath committee that submitted its report to finance minister Pranab Mukherjee on June 7 this year.

Jayant Pai has an interesting comment on ppfas blog which goes like this

By now you must be aware that the interest rates on Government Small Savings Schemes (SSS) have been increased. Newspapers are going around town proclaiming that this is a bonanza for small investors. Well, it is true that soon (Most probably from December 1, 2011) you will be earning more by investing in these instruments but in a way this move is similar to the recent deregulation of bank savings account rates by the Reserve Bank of India .

You may be earning more today but this could change in the future. In other words, interest rates on all SSS will be dynamic and linked to the yield for comparable Government Securities although the rate changes will occur only once in a year and the relevant announcement will be made on April 1 each year. The Government will however ensure that a spread ranging from 25 to 50 basis points over the relevant benchmark security will be maintained.

Note that the news of PPF interest hike was published on Jagoinvestor news blog within few minutes of govt decision

Get your CIBIL credit score on your mobile phone

Credit Information Bureau of India (Cibil) is planning to introduce credit scores on mobile phone directly . As of now one can get his credit scores only from CIBIL by paying a fee and sending a document to CIBIL. But now CIBIL wants to make sure the credit score reaches people as fast as possible and for this they are in talks with various service providers like Vodafone and Bharti Airtel.

“Mobile transactions would change the way the industry is functioning. That’s our next focus. That’s where the growth will happen. We will be able to give the credit report to customers on their mobile immediately. We are exploring this possibility,” said Arun Thukral, MD, Cibil.

મુંબઇના રિયલ એસ્ટેટ માર્કેટમાં મંદી

કેટલાક ડેવલપરોએ તેમના નવા પ્રોજેક્ટ નીચા ભાવે લોન્ચ કર્યા છે ત્યારે મોટા ભાગના ડેવલપરોએ ઘરની રચનામાં ફેરફાર , એફોર્ડેબલ હાઉસ પર વધુ ભાર મુકવા જેવા વિકલ્પો અપનાવ્યા છે. કેટલાક ડેવલપરોએ તેમના મુંબઇના પ્રોજેક્ટ થોડા સમય માટે મુલતવી રાખ્યા છે.

દાખલા તરીકે , આકૃતિ સિટીએ અંધેરીમાં હિક્રેસ્ટ નામનો પ્રિમીયમ રેસિડેન્શિયલ પ્રોજેક્ટ લોન્ચ કર્યો. તેનો ભાવ તેણે આ વિસ્તારના વર્તમાન બજાર ભાવ ચોરસ ફૂટ દીઠ રૂ. 12,500 ના સ્થાને રૂ. 10,900 નો રાખ્યો છે.

સુનિલ મંત્રી રિયલ્ટી મુંબઇમાં લોન્ચ થઇ રહેલી તેની બે પ્રોપર્ટીમાં તેના એપાર્ટમેન્ટનું કદ ઘટાડી રહી છે. કંપનીના મેનેજિંગ ડિરેક્ટર સુનીલ મંત્રીએ જણાવ્યું હતું કે , અમારે અમારી વ્યૂહરચના બદલવી પડી છે.

સોદાનું કદ મોટા હોય છે તેવા મુંબઇ અને દિલ્હી જેવા મોટા મેટ્રોમાં કિંમત સંવેદનશીલતા વધુ હોય છે. મંત્રીએ જણાવ્યું હતું કે , વર્તમાન સ્થિતિમાં ગ્રાહકને આકર્ષવા માટે પ્રોડક્ટનું કદ અતિમહત્ત્વનું પરિબળ છે.

આની સામે એમજી ગ્રૂપે તેના મુંબઇ આયોજનને બે વર્ષ સુધી મુલતવી રાખ્યું છે તેમ કંપનીના મેનેજિંગ ડિરેક્ટર મુધિત ગુપ્તાએ જણાવ્યું હતું. તેમણે જણાવ્યું હતું કે , અમને નથી લાગતું કે અત્યારે મુંબઇ તેજસ્વી બજાર હોય.તેના સ્થાને તે ઉંચા વેચાણની ક્ષમતા હોય તેવા શહેરો અને રાજ્યો પર ધ્યાન કેન્દ્રિત કરી રહ્યાં છે.

કંપનીએ છેલ્લા ત્રણ મહિનામાં ગોવામાં તેના લક્ઝરી પ્રોજેક્ટ અનંતમમાં રૂ. 2 થી 6 કરોડની રેન્જમાં 25 એપાર્ટમેન્ટ વેચ્યા છે. તેઓ ઉમેરે છે કે , આજે રોકાણકારો માટે ગોવા મુંબઇ કરતા વધુ સલામત છે.

ડુંગળીના ખેડૂતો મુશ્કેલીમાં : ભાવમાં 40 ટકાનો ઘટાડો

સામાન્ય રીતે ચોમાસામાં વરસાદની સિઝન દરમિયાન દેશની માંગને પહોંચી વળવા ઉનાળુ ડુંગળીનો સંગ્રહ કરવામાં આવે છે , જે ઓક્ટોબર પછી ખેડૂતોને સારા ભાવ આપે છે. આ માટેનું કારણ એ છે કે આ ગાળો પરિવર્તનનો ગાળો છે. તેમાં ડુંગળીના સંગ્રહિત જથ્થામાં ઘટાડો થવાની શરૂઆત થાય છે અને નવી ખરીફ ડુંગળીનું આગમન ધીમે ધીમે વેગ પકડે છે. જોકે ચાલુ વર્ષે ઓકટોબરમાં પણ ડુંગળીના ભાવમાં વધારો થયો નહોતો.

નિકાસકારોમાં પણ નિરાશા પ્રવર્તે છે. ચાલુ વર્ષે ડુંગળીની નિકાસમાં ઘટાડો થયો છે. આ માટે મુખ્યત્વે બે કારણ જવાબદાર છે. એક , અન્ય દેશોમાંથી ડુંગળીની મોટા પાયે નિકાસ થઈ રહી છે. બે , આ દેશોની ડુંગળીની સરખામણીમાં ભારતીય ડુંગળીના ભાવ ઊંચા છે.

નાફેડ પાસે ઉપલબ્ધ આંકડા મુજબ , ચાલુ વર્ષે એપ્રિલથી સપ્ટેમ્બરમાં ડુંગળીની નિકાસ 6.66 લાખ ટન થઈ છે જ્યારે ગયા વર્ષે સમાન ગાળામાં 9.34 લાખ ટન ડુંગળીની નિકાસ થઈ હતી.

લાસલગાંવમાં ગયા વર્ષે સપ્ટેમ્બરમાં ડુંગળીના સરેરાશ માસિક ભાવ ક્વિન્ટલ દીઠ રૂ. 1,350 હતા જ્યારે ચાલુ વર્ષે સપ્ટેમ્બરમાં સરેરાશ ભાવ ક્વિન્ટલ દીઠ રૂ. 1,050 હતા. આ જ મંડીમાં ઓક્ટોબર 2010 માં સરેરાશ જથ્થાભાવ ક્વિન્ટલ દીઠ રૂ. 1,350 હતા.

ચાલુ વર્ષે અહીં આ જ મહિનામાં ડુંગળીના ભાવ ક્વિન્ટલ દીઠ રૂ. 750 થી રૂ. 850 હતા , જે ગયા વર્ષના સમાન ગાળાના ભાવની સરખામણીમાં આશરે 40 ટકા ઓછા હતા.

દેવાના સંકટમાંથી બહાર આવવા કિંગફિશર પ્રોપર્ટી વેચશે

|

5 વર્ષમાં ચીનનું 10 અબજ ડોલરનું રોકાણ મેળવવાની ગુજરાતની આશા

પ્રતિનિધિમંડળે પત્રકાર પરષિદને જણાવ્યું હતું કે ગુજરાતનો ઊંચો વૃદ્ધિદર અમેરિકા અને યુરોપ સિવાય અન્ય દેશોમાં રોકાણ કરવા માંગતી ચીનની કંપની માટે આકર્ષણનું કેન્દ્ર બન્યો છે. કમ્યુનિસ્ટ પાર્ટી ઓફ ચાઇનાના આમંત્રણ પર ગુજરાતનું પ્રતિનિધિમંડળ ચીનની મુલાકાતે ગયું હતું.

રિલાયન્સ ઇન્ડસ્ટ્રીઝના ગ્રૂપ પ્રેસિડન્ટ (કોર્પોરેટ અફેર્સ) પરિમલ નથવાણીએ જણાવ્યું હતું કે , ચીન અબજો ડોલરની પુરાંત ધરાવે છે અને અમેરિકા અને અન્ય પશ્ચિમી દેશમાંથી મળતા વળતરથી નિરાશ છે. ભારત અને તેમાં પણ ખાસ કરીને ગુજરાત ઊંચા વૃદ્ધિદરને કારણે ચીનના રોકાણકારોમાં મહત્ત્વ મેળવી રહ્યું છે.

રાજ્ય સરકારે ચીનની કંપનીઓને વીજળી , રિન્યુએબલ એનર્જી , વેસ્ટ મેનેજમેન્ટ , શહેરી આવાસ , મેટ્રો રેલમાં રોકાણ કરવા આમંત્રણ આપ્યું હતું , જ્યારે સ્થાનિક કંપનીઓ ચીનની કંપનીઓ સાથે સંયુક્ત સાહસ રચવાની અને ટેક્નોલોજી ટ્રાન્સફરની ઇચ્છા ધરાવે છે.

રાજ્ય સરકારના અધિકારીઓ માને છે કે ચીન આગામી પાંચ વર્ષમાં ભારતમાં 100 અબજ ડોલરનું રોકાણ કરવા ઇચ્છે છે અને ગુજરાત તેનો ઓછામાં ઓછો 10 ટકા હિસ્સો આકર્ષશે. આગામી વાઇબ્રન્ટ ગુજરાત ગ્લોબલ સમિટ 2013 માં ચીનની 200 થી વધુ કંપનીઓ ભાગ લે તેવી શક્યતા છે એમ રાજ્યના ઉદ્યોગ અને ખાણ વિભાગના અગ્ર સચિવ મહેશ્વર સાહુએ જણાવ્યું હતું.

અમદાવાદ સ્થિત કિરી ઇન્ડસ્ટ્રીઝ લિમિટેડે મ્યુનિસિપલ ઘન કચરામાંથી વીજળી પેદા કરવા માટે તકનીકી જોડાણ અને ટેક્નોલોજી ટ્રાન્સફર માટે બેઇજિંગ મ્યુનિસિપલ કોર્પોરેશન અને તેની એન્જિનિયરિંગ સંસ્થા સાથે જોડાણ કર્યું છે.

બજારનું ધ્યાન ફુગાવો,ઇટલીની ઘટના પર રહેશે

એમ્બિટ કેપિટલના હેડ-ઇક્વિટીઝ સૌરભ મુખરેજાએ જણાવ્યું હતું કે , ઇટલી વૈશ્વિક ધ્યાનના કેન્દ્રમાં છે. આગામી સપ્તાહમાં બજેટમાં કડક નાણાકીય પગલાં (ઓસ્ટેરિટી)ને પસાર કરવામાં તેની સફળતા કે નિષ્ફળતાની શેરબજારો પર નોંધપાત્ર અસર પડશે.

ગયા શુક્રવારે ભારતીય શેરબજારોએ છેલ્લાં સાત સપ્તાહમાં સૌથી મોટો સાપ્તાહિક ઘટાડો નોંધાવ્યો હતો. ઔદ્યોગિક ઉત્પાદનમાં અંદાજિત કરતાં ધીમી વૃદ્ધિ અને નાણાકીય ક્ષેત્રની કંપનીઓના શેરો માટે નબળા સંજોગોના કારણે સેન્સેક્સ ગયા સપ્તાહ દરમિયાન 2 ટકા ઘટ્યો હતો.

Wednesday, November 2, 2011

How do Highest NAV Guarantee Plans work ?

In this article, we look at how Highest NAV Guarantee ULIP’s work, and you will understand, how any Guarantee product can be created by simple methods . The simple catch, here is that these schemes, are structured in such a manner, that the collected funds can be invested either in equities, debt instruments or in money-market instruments in proportions varying from zero to 100%

How Highest NAV Guarantee Policy Works ?

These plans use strategies like Dynamic Hedging and CPPI (Constant proportion portfolio insurance), which are advanced strategies used in Derivatives world. But, let me explain a simplified version of the whole process.

Supposing a policy starts today and is guaranteed to give highest NAV in next 7 yrs and we can control how money moves to debt and equity, its pretty simple.

In the beginning, let’s assume a NAV of Rs 10, and the Asset allocation is 100% in equity and 0% in debt . Now suppose, the market moves up and NAV goes upto Rs 15 by the end of the first year, at this point, try to understand what Insurance company has to provide – they have to make sure, that they provide at least Rs 15 as the return after 6 yrs . Now in order to achieve this, all they have to do is keep X amount in debt instruments which will mature in next 6 years and provide Rs 15 at the end of 6 yrs, so assuming the debt return at 7%, they need to put around Rs 10 in Bonds , so that the maturity of the bond is Rs 15 at the end of 6 yrs .

=> 10 * (1.07)^6=> 15.007

They can now invest the rest Rs 5 in Equity as Rs 10 is allocated to Debt . So, now they’ve made sure that whatever happens to the market, they get Rs 15 for sure at the end of 6 yrs. Now, there are two possibilities

Case 1 : Market Goes down : If market goes down, the NAV will go down correspondingly, but as per the strategy, the maturity value will be at least Rs 15.

Case 2 : Market Goes up again : If market goes up at this point and the NAV rises above 15, for example say to Rs. 18, now again they will pull out money from Equity and allocate such an amount to debt, that the maturity at the end of total 7 yrs would be Rs 18 and so on…

Note :

These highest guaranteed schemes do not provide wide range of product categories, such as equity-oriented growth funds, balance funds and debt funds.

Guarantee on highest NAV is available only if you survive the term. If you die during the term, your nominees will get the prevailing value of the fund. This is inferior to even a regular debt product because of the high cost structure involved.

Following is a pictorial description of how the Guaranteed NAV plan works with assumption of a 7 year tenure.

How Investors get Confused

You have to read in between the lines; Investors need to understand that these schemes guarantee the “Highest NAV”, READ AGAIN! , it’s Highest NAV and not “Highest Returns” . Normal Investors don’t give much thought before buying these products and normally assume that the returns will be linked to the Equity Markets .

Do you Know , you can Now Subscribe to All the Comments on JagoInvestor !! (You can Unsubscribe Later)

Returns from Highest NAV Guarantee Plans

So, what are the return expectations of these funds? We know, that long-term equity returns, are normally in the 12-15% range while, debt returns turn out to be 6-7%. So, considering the fact, that these products will shift most of their money to debt, by the end of the tenure , we can expect the returns to be in range of 9-10%. We do get some equity upside in these products, but that will be limited. After a point, this product will turn into a debt oriented fund with a major portion in debt . Also if you factor in costs, like premium allocation charges , fund management charges and other yearly charges, the returns will not be what you actually expect.

You will be amazed to know, that the returns expected from these schemes, may be lower than the returns offered by equity-oriented Ulips. The reason being, that the basic objective of protecting the previous high NAV of the fund, may constrain the fund manager’s ability to take risks while allocating funds. So if the market has fallen down, the fund manager can’t take the risk of shifting the money from Debt to Equity to gain from the potential upsides in future , because they have to provide the “Guarantee.”

Read : Important Questions you should Ask an ULIP Agent ?

Source : LiveMint Research

Current Products in Market with Highest NAV Guarantee

ICICI’s Pinnacle

Birla Sun Life Platinum Plus-III

Bajaj Allianz Max Gain

SBI Life Smart Ulip

Tata AIG Apex Invest Assure

LIC Wealth Plus

Reliance Highest NAV Guarantee Plan.

AEGON Religare Wealth Protect Plan

Controlling your emotions with these products

Let’s talk about mistakes from the investors point of view. We, as investors, don’t think with inquisitive, susceptive minds. Getting good returns from stock markets is anyways a tough thing in itself. So when these companies come up with plans like these, which say “highest NAV in 7 yrs”, we have to ask, “How is this possible?” . Dont say it’s not possible at all, just ask how? How do they achieve it? Stop seeing dreams of getting high returns without looking at the risk involved, and try to find out – what is the strategy they’re using , Is there something in between the lines ?

We all want to get great returns, but we have to shed this belief that, companies come up with plans specially for us. All the companies out there exist to earn money, and their motive behind every product is to make money, & generate profits for their companies, so that they keep their shareholders happy. So next time a product like this comes up , you have to control your emotions before getting in and first investigate. The worst part of this whole business, (of guaranteed highest NAV products) is the timing and how it gives naive investors, high illusions about the product. Products like these, take major advantage of psychology of the ordinary saver. Many Investors in smaller towns have broken their Fixed Deposits and taken some loan to invest in products like these, especially SBI Life Smart Ulip and LIC Wealth Plus because of the trust factor with LIC and SBI . See How Agents are Misselling LIC Wealth Plus

Why you should be “Pissed off” At these Insurance Companies

Do you Know that, The Securities & Exchange Board of India (SEBI) , the stock market and mutual fund regulator, does not allow mutual funds to guarantee returns. Therefore Mutual funds can not provide guaranteed products which are related to stock markets, but IRDA can approve things like these and all these insurance companies come under the ambit of Insurance Regulatory and Development Authority of India (IRDA). So any Insurance Company can come up with a new Plan , link it with market and start providing “Guaranteed products” . You have to understand that “equity markets” and “guarantees” are a very risky idea together , so please stay away.

Do you observe when do all these “Innovative” products come up in Market ? The answer is around end of the year, which is a premier Tax Investment time (Jan , Feb , Mar) . Is innovation in Finance space limited to End of the year ? Why dont these products come through out the year? Why ? The answer is simple , if it comes after anytime other than last 4-5 months of the Financial Year (ie Dec , Jan , Feb , Mar) , no body will bother to invest in these, because no body is bothered to “invest” at all . Companies very well understand investors psychology and their helpless ness at the end of the year because they have to provide investment proofs for Tax exemption as soon as possible . This is not just limited to these products , its true for NFO’s , IPO’s in booming markets , More Sales calls at the end of the year, and other new products .

The so-called “Guarantee” is a marketing gimmick and is implicitly a result of the way the investment is structured . what it means is that the strategy they use itself is such that it will provide you the highest NAV , even we can create our own Plan and do what they are doing . But they make sure that Investors feel like they have done years of research and came up with these amazing plans .

Why The Tenure is 7 yrs ? I am not very sure on this , but here are my thoughts on comments area

You have to understand that there is nothing “Innovative” in this product , the fact that 7 companies have come up with the same product proves that its not “innovation” because Innovation is unique . Aegon Religare has gone ahead in this stupidity and introduced their Guaranteed Plan which guaranteed 80% of the Highest NAV , Looks like they think that it makes them look different from others .

Economic Event Calendar

Best Mutual Funds

Recent Posts

Search This Blog

IPO's Calendar

Market Screener

Industry Research Reports

INR Fx Rate

NSE BSE Tiker

Custom Pivot Calculator

Popular Posts

-

LIC Term Insurance or Pvt Life Insurance Term Plan ? Which is the best term insurance in India ? Which Insurance company has the best cla...

-

આજકાલ કોઈપણ સમસ્યા હોય લોકો એન્ટિબાયોટિક્સ અંગ્રેજી દવાઓ લેવાનું વધુ પસંદ કરતાં હોય છે કારણ કે આજની પેઢીને આપણા જુનવાણી નુસખા વિશે જાણ હોત...

-

Introduction The Japanese began using candlestick patterns for over 100 years before the West developed the bar and point and figure syst...

-

સેબીએ કોમોડિટી ડેરિવેટિવ્ઝ માર્કેટના નિયમનને કડક બનાવ્યાના એક વર્ષ પછી કોમોડિટી એક્સ્ચેન્જિસની વૃદ્ધિના પગલાની શરૂઆત કરી છે. MCX અને NCDEX ...

-

મ્યુચ્યુઅલ ફંડ્સના સોદામાં ઉચ્ચ સ્તરની પારદર્શકતા આવે તે હેતુથી શેરબજાર નિયમનકારી સંસ્થા સેબીએ એજન્ટ્સને ચૂકવેલું પુરેપુરું કમિશન જાહેર કરવ...

-

Equity Linked Savings Scheme (ELSS) is the best tax saving (Section 80C) investment option for investors looking to create long term w...

-

While investing in Mutual Funds, you go through fund reviews, watch funds performance, track historical performance, find out what ex...

-

સીબીઆઈ કોર્ટે બુધવારે એફટીઆઈએલ જૂથના સ્થાપક જિજ્ઞેશ શાહને 26 સપ્ટેમ્બર સુધી પોલિસ કસ્ટડીમાં રાખવા આદેશ આપ્યો હતો. સીબીઆઈએ 30 સપ્ટેમ્બર સુ...

-

મેનેજમેન્ટ સ્નાતકો માટે ઇન્વેસ્ટમેન્ટ બેન્કિંગમાં કારકિર્દી હંમેશા આકર્ષક રહી છે. જોકે, હવે આ સેક્ટરના પડકારોને લીધે ઘણા મેનેજમેન્ટ સ્નાત...

-

The Federal Open Market Committee (FOMC), a branch of the US Federal Reserve Board that decides US monetary policy, meets eight times ever...