The Hindu Undivided Family (HUF) structure is a very effective way to

save tax and a lot of people are eligible to create HUFs but somehow

there is very little awareness about it.

I think that’s because most of us don’t know how easy it is to create an HUF. In fact, it is as easy as getting married. I would say it might be difficult for somebody to get married but it is very easy to create an HUF.

An HUF is automatically constituted the moment a person gets married and completes seven pheras around the holy fire and they get married.

That means a Hindu male needs to do nothing to get an HUF created but to get married to a Hindu female. It is one marriage gift that all Hindus get from the government or Hindu Law. It is not necessary to have children to create HUF.

Sikhs, Jains and Buddhists can also create an HUF under the Income Tax Act even though they are not governed by the Hindu law.

What is an HUF?

An HUF is a separate and a distinct tax entity. The income of an HUF can be assessed in the hands of the HUF alone and not in the hands of any of its members. The senior most member of the family who manages the affairs of the family is called the Karta. Minimum two people (at least one male member) are required for the HUF to come into an existence.

A coparcener is a member of the HUF, who by birth acquires an interest in the joint property of the family, whether inherited or otherwise acquired by the family.

Coparceners have a right to claim partition of the HUF. Other members of the family cannot ask for a partition of the HUF and have no right to claim a share in the family property. Coparceners consist of a Karta and his lineal descendants within the following four degrees:

A daughter, after her marriage, would remain a coparcener in her father’s HUF and at the same time, can become a member in her husband’s HUF. In the event of the death of the Karta and in the absence of any male member, two females can continue to run the HUF and the senior female can take over as the Karta. A son can create his own HUF while remaining a coparcener in his father’s HUF.

Capital Infusion: Here comes the most difficult part for someone to start the HUF operating – generating capital for the HUF.

One should not contribute his own personal assets or funds into the HUF as any income generated from these assets or from its investment will be clubbed into Individual’s personal income under Section 64 (2) of the Income Tax Act and hence taxed accordingly.

But there is a way out – one can transfer his personal assets or funds into the HUF if the income generated from these assets or from its investment results in a tax free income (like tax free bonds) and hence there is no scope of any tax liability due to clubbing of taxable income.

This tax free income can then be reinvested to earn even taxable income and eventually all of the income would fall out of the clubbing provisions.

Gifts or inheritances meant for the benefit of all the members of a family should be diverted specifically to the HUF. HUFs are liable to pay tax if the value of the gifts taken from the strangers exceeds Rs. 50,000. Though there is a limit for an HUF to take gifts from the strangers, gifts of a higher value can be taken from the relatives, who are not the members of the HUF.

Here is the list of people who fall in the category of relatives:

How to get started with the HUF?

Once there are two eligible family members ready to operate an HUF, the first thing to do is to apply for a PAN card in the name of the HUF and have a separate bank account opened.

For a PAN application, an affidavit by the Karta stating the name, father’s name and address of all the coparceners on the date of the application is considered sufficient as the document proof of identity of the HUF. Also, the identity and address proof of the karta will be treated as the address proof of the HUF.

Then start seeking for gifts or inheritances from relatives or strangers, keep on infusing your own capital, transfer family’s assets/properties to the HUF and do all the possible things that you can keeping in mind the clubbing of income provisions.

Here is a link that contains a sample HUF deed.

Sections/Provisions under which HUFs can claim Deduction/Exemptions and Save Tax

As already mentioned, an HUF is a separate and a distinct tax entity and just like any other Resident Individual assessee, it also enjoys a basic tax exemption of Rs. 2,00,000. All other tax slabs are also exactly same as for an Individual. Here is a useful link from Bemoneyaware that shows the TDS rates for Individuals and HUFs.

Section 80C: HUFs can claim tax exemption under Section 80C by investing money in ELSS, ULIPs, traditional insurance plans, NSC or 5 year Bank FD with a scheduled bank. Principal repayment on a housing loan taken by the HUF can also be claimed under this section. HUFs are not allowed to invest in PPF anymore.

Section 80D: Members of the HUF can take a family floater policy and make the HUF pay for its premium and enjoy the tax benefit too.

Section 80DD: If any dependant member of the HUF is normally disabled (not less than 40% disabled) and the HUF makes an expenditure for the medical treatment, training and rehabilitation of that disabled member, then the HUF can claim a deduction of Rs. 50K under this section. If the condition is of a severe disability (equal to or more than 80%) then the HUF can claim a deduction of Rs. 100,000.

Section 80TTA: Interest earned on the money deposited in the savings bank account up to Rs. 10,000 p.a. is exempt for an HUF also.

Section 24 (b): Interest on Housing Loan: If an HUF takes a loan for buying out a residential property, it can claim a deduction of Rs. 150,000 in respect of Interest on Housing Loan.

30% Standard Deduction on a Rented Property: An HUF can claim a standard deduction of 30% from the rental income it earns by letting out a property.

Capital Gains on a House Property: Tax on Capital Gains made by selling a house property can be saved if the HUF invests the proceeds into buying another property within two years from the sale of the said property. The money can also be invested in Capital Gain bonds offered by REC and NHAI with a lock-in period of 3 years. The interest income on these bonds would be considered a taxable income of the HUF.

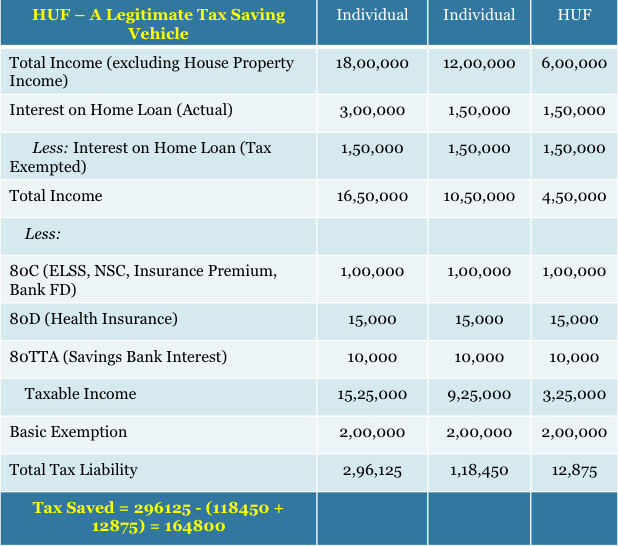

The table below shows how the income of an individual in the 30% tax bracket can be split between two entities to lower the final tax outgo:

Some Other Important Points

I think that’s because most of us don’t know how easy it is to create an HUF. In fact, it is as easy as getting married. I would say it might be difficult for somebody to get married but it is very easy to create an HUF.

An HUF is automatically constituted the moment a person gets married and completes seven pheras around the holy fire and they get married.

That means a Hindu male needs to do nothing to get an HUF created but to get married to a Hindu female. It is one marriage gift that all Hindus get from the government or Hindu Law. It is not necessary to have children to create HUF.

Sikhs, Jains and Buddhists can also create an HUF under the Income Tax Act even though they are not governed by the Hindu law.

What is an HUF?

An HUF is a separate and a distinct tax entity. The income of an HUF can be assessed in the hands of the HUF alone and not in the hands of any of its members. The senior most member of the family who manages the affairs of the family is called the Karta. Minimum two people (at least one male member) are required for the HUF to come into an existence.

A coparcener is a member of the HUF, who by birth acquires an interest in the joint property of the family, whether inherited or otherwise acquired by the family.

Coparceners have a right to claim partition of the HUF. Other members of the family cannot ask for a partition of the HUF and have no right to claim a share in the family property. Coparceners consist of a Karta and his lineal descendants within the following four degrees:

- 1st Degree: Holder of the ancestral property for the first time – Karta

- 2nd Degree: Son(s) and Daughter(s) of the Karta

- 3rd Degree: Grandson(s) of the Karta

- 4th Degree: Great Grandson(s) of the Karta

A daughter, after her marriage, would remain a coparcener in her father’s HUF and at the same time, can become a member in her husband’s HUF. In the event of the death of the Karta and in the absence of any male member, two females can continue to run the HUF and the senior female can take over as the Karta. A son can create his own HUF while remaining a coparcener in his father’s HUF.

Capital Infusion: Here comes the most difficult part for someone to start the HUF operating – generating capital for the HUF.

One should not contribute his own personal assets or funds into the HUF as any income generated from these assets or from its investment will be clubbed into Individual’s personal income under Section 64 (2) of the Income Tax Act and hence taxed accordingly.

But there is a way out – one can transfer his personal assets or funds into the HUF if the income generated from these assets or from its investment results in a tax free income (like tax free bonds) and hence there is no scope of any tax liability due to clubbing of taxable income.

This tax free income can then be reinvested to earn even taxable income and eventually all of the income would fall out of the clubbing provisions.

Gifts or inheritances meant for the benefit of all the members of a family should be diverted specifically to the HUF. HUFs are liable to pay tax if the value of the gifts taken from the strangers exceeds Rs. 50,000. Though there is a limit for an HUF to take gifts from the strangers, gifts of a higher value can be taken from the relatives, who are not the members of the HUF.

Here is the list of people who fall in the category of relatives:

- Karta’s Wife

- Brother(s) or Sister(s) of the Karta

- Brother-in-law or Sister-in-law of the Karta

- Immediate Uncle(s) or Aunt(s) of the Karta

- Immediate Uncle-in-law or Aunt-in-law of the Karta

- Lineal ascendant or descendent of the Karta or Karta’s wife

How to get started with the HUF?

Once there are two eligible family members ready to operate an HUF, the first thing to do is to apply for a PAN card in the name of the HUF and have a separate bank account opened.

For a PAN application, an affidavit by the Karta stating the name, father’s name and address of all the coparceners on the date of the application is considered sufficient as the document proof of identity of the HUF. Also, the identity and address proof of the karta will be treated as the address proof of the HUF.

Then start seeking for gifts or inheritances from relatives or strangers, keep on infusing your own capital, transfer family’s assets/properties to the HUF and do all the possible things that you can keeping in mind the clubbing of income provisions.

Here is a link that contains a sample HUF deed.

Sections/Provisions under which HUFs can claim Deduction/Exemptions and Save Tax

As already mentioned, an HUF is a separate and a distinct tax entity and just like any other Resident Individual assessee, it also enjoys a basic tax exemption of Rs. 2,00,000. All other tax slabs are also exactly same as for an Individual. Here is a useful link from Bemoneyaware that shows the TDS rates for Individuals and HUFs.

Section 80C: HUFs can claim tax exemption under Section 80C by investing money in ELSS, ULIPs, traditional insurance plans, NSC or 5 year Bank FD with a scheduled bank. Principal repayment on a housing loan taken by the HUF can also be claimed under this section. HUFs are not allowed to invest in PPF anymore.

Section 80D: Members of the HUF can take a family floater policy and make the HUF pay for its premium and enjoy the tax benefit too.

Section 80DD: If any dependant member of the HUF is normally disabled (not less than 40% disabled) and the HUF makes an expenditure for the medical treatment, training and rehabilitation of that disabled member, then the HUF can claim a deduction of Rs. 50K under this section. If the condition is of a severe disability (equal to or more than 80%) then the HUF can claim a deduction of Rs. 100,000.

Section 80TTA: Interest earned on the money deposited in the savings bank account up to Rs. 10,000 p.a. is exempt for an HUF also.

Section 24 (b): Interest on Housing Loan: If an HUF takes a loan for buying out a residential property, it can claim a deduction of Rs. 150,000 in respect of Interest on Housing Loan.

30% Standard Deduction on a Rented Property: An HUF can claim a standard deduction of 30% from the rental income it earns by letting out a property.

Capital Gains on a House Property: Tax on Capital Gains made by selling a house property can be saved if the HUF invests the proceeds into buying another property within two years from the sale of the said property. The money can also be invested in Capital Gain bonds offered by REC and NHAI with a lock-in period of 3 years. The interest income on these bonds would be considered a taxable income of the HUF.

The table below shows how the income of an individual in the 30% tax bracket can be split between two entities to lower the final tax outgo:

Some Other Important Points

- Karta can be paid a reasonable salary for his services of managing day to day affairs of the HUF. The salary will be considered his personal income but at the same time it is deductible as an expense from the books of the HUF.

- Only one member or coparcener cannot form an HUF. There have to be at least two members and at least one male member.

- HUF can keep its normal functioning even with two females after the death of its sole male member.

- The Hindu Succession (Amendment) Act 2005 has given equal rights to male and female in the matters of inheritance as a result of which a daughter now also acquires the status of a coparcener.

- An HUF cannot become partner in a firm but a Karta can.

No comments:

Post a Comment